When Can I Put Money In Roth Ira 2025 - roth ira vs traditional ira Choosing Your Gold IRA, The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if. In 2025, that means you can contribute toward your 2023 tax year limit of. Maximum Contribution Roth Ira 2025 Linea Petunia, The maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2023) if you're younger than age 50. Those over 50 can still contribute up to $1,000 more in 2025, meaning that the limit is now $8,000.

roth ira vs traditional ira Choosing Your Gold IRA, The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if. In 2025, that means you can contribute toward your 2023 tax year limit of.

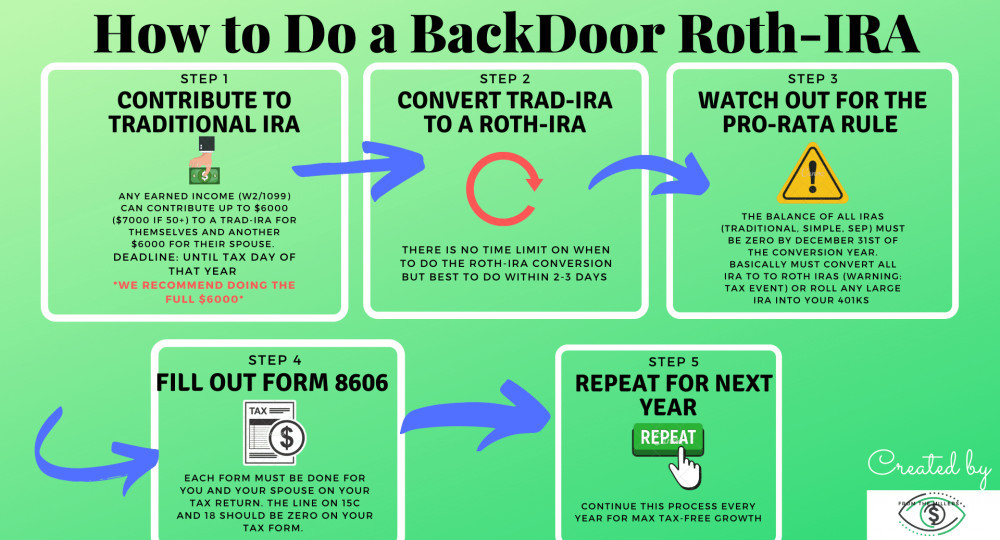

Why Most Pharmacists Should Do a Backdoor Roth IRA, But, your income could also make you ineligible to contribute to a roth ira. The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Traditional Ira Tax Deduction Limits 2025 Eryn Odilia, Ira account holders can contribute up to $7,000 in 2025, which is a $500 jump over the 2023 cap. In 2025, you can contribute up to $7,000 in your.

Those over 50 can still contribute up to $1,000 more in 2025, meaning that the limit is now $8,000.

You can make 2025 ira contributions until the. The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

When Can I Put Money In Roth Ira 2025. Less than $146,000 if you are a single filer. In 2025, the roth ira contribution limit is $7,000, or $8,000 if you're 50 or older.

The contribution limit for a roth ira is $6,500 (or $7,500 if you are over 50) in 2023.

Savings Account vs. Roth IRA What’s the Difference?, In 2025, the roth ira contribution limit is $7,000, or $8,000 if you're 50 or older. For 2025, maximum roth ira contributions are $7,000.

Roth IRA For Kids Make Your Grandchildren Millionaires RetireGuide, In 2025, the roth ira contribution limit is $7,000, or $8,000 if you're 50 or older. You cannot deduct contributions to a roth ira.

Last Day To Contribute To 2025 Roth Bill Marjie, 12 rows the maximum total annual contribution for all your iras combined is: The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if.

What Is A Backdoor Roth IRA? How Does It Work In 2025? Personal, In 2023, roth ira contributions were capped at $6,500 per year, or $7,500 per year if you were 50 or older. This limit is now indexed for inflation and the irs updates the contribution limits every few years, if not annually.